EBI - Risk Assessment

The bottom line: Using EBI, the probability of suffering a loss in a year is estimated at 9.4%. Details of the analysis are explained below.

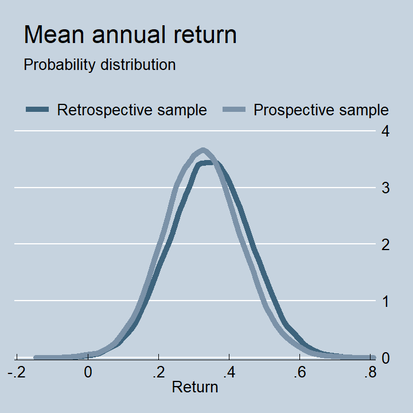

Mean annual return

Confidence intervals for the mean annual return of EBI were estimated as an initial measure of risk. To do so, a probability distribution was created by resampling observations from the group of countries ranked first (the "Top 1" group). More specifically, a new sample was created by randomly replacing a country from the "Top 1" group by other country from the same group. For each new sample a mean annual return was calculated. This operation was repeated 50 thousand times. The distributions were estimated for the retrospective (assuming the "unlucky" scenario) and prospective samples separately.

In the retrospective sample the 95% confidence interval (CI) for the mean annual return is 12% - 57%, while in the prospective sample the CI is 10% - 50%. Although intervals are wide, their lower bounds are fairly high. They indicate that the mean annual return of EBI is higher than 10% with 97.5% confidence.

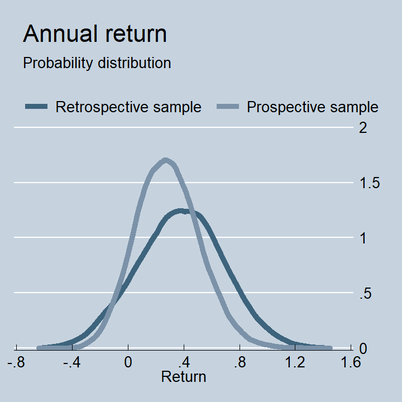

Annual return and probability of loss

A slightly different question refers to the range of the return that could be obtained in a year. Knowing the probability distribution of the annual return allows us to estimate the probability of having a negative return during a specific period. As before, bootstrapping was applied to randomly select four quarterly returns from the retrospective and prospective periods separately, and these were used to generate annual returns.

Data from the prospective sample indicate that the probability of having a positive return over a 4-quarter period is 90.6%. In other words, the probability of suffering a loss in any year is 9.4% (CI 7.7% - 11.2%).

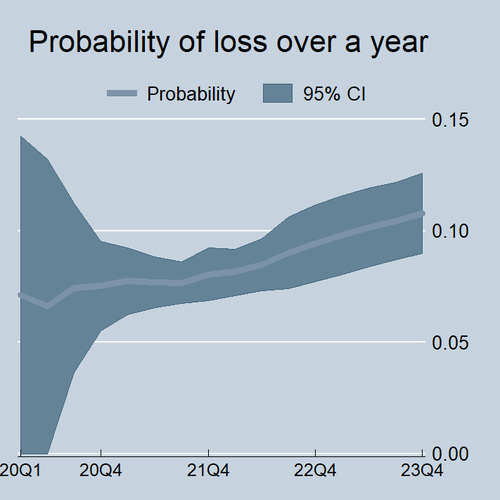

The figure below shows the annual probability of loss estimated at the end of each quarter since 2020q1 (before the Covid-19 pandemic the estimated probabilty was close to zero). The probabilty has moved between 6.6% and 10.8% since the pandemic.

The figure below shows the annual probability of loss estimated at the end of each quarter since 2020q1 (before the Covid-19 pandemic the estimated probabilty was close to zero). The probabilty has moved between 6.6% and 10.8% since the pandemic.

A probability of loss over a year of 9.4% means that EBI is expected to have a negative annual return roughly every 9.2 years. As a reference, over the 10-year period from 2014 to 2023 the S&P 500 return in euros was negative on two occasions (2018 and 2022), the Stoxx Europe 600 on four (2015, 2018, 2020 and 2022), and the MSCI World on two (2018 and 2022). The risk analysis will be updated as more data come out of the prospective phase.